Arcticdude

Top Poster

Don't trust it. I'll stick to what has always worked for me. I've done very good in real estate and the stock market. I don't do risky investment's anymore.

Even the stock market has its risks. The Dow has taken a beating in the last couple days. It dropped 1200 points just today, or almost 5%.

Here is what that "recovery" looks like on a 3 month chart - that little uptick at the end. For it even to be the least bit encouraging, it would have to get back above the previous support trend (red line - which is going down itself)Crypto went back up after the 3 PM market crash. Back to where they were before the dip.

BTFD? Seems dangerous...

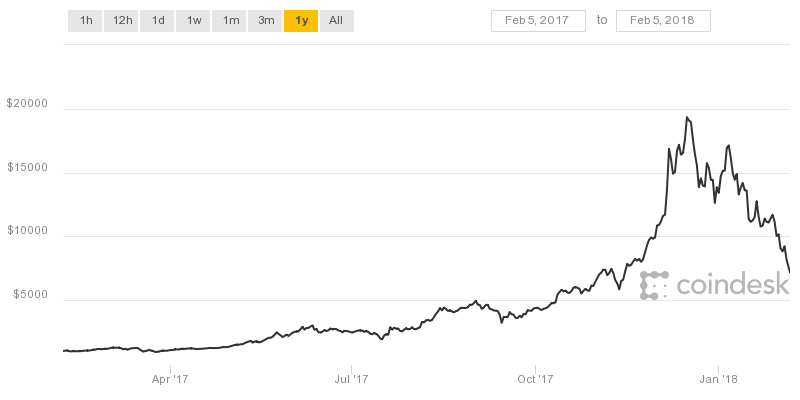

I believe it’s all over China and India threatening delegitimization of it. I think japan and s Korea have an impact as well. Face it, governments are threatened by something they aren’t assured their cut from.Though the Dow going down is actually a good thing, it need to head towards correction and back down to reality. Though I fear inflation may fallow all the good economic news. I am wondering what’s fueling the crypto currency spiraling down?

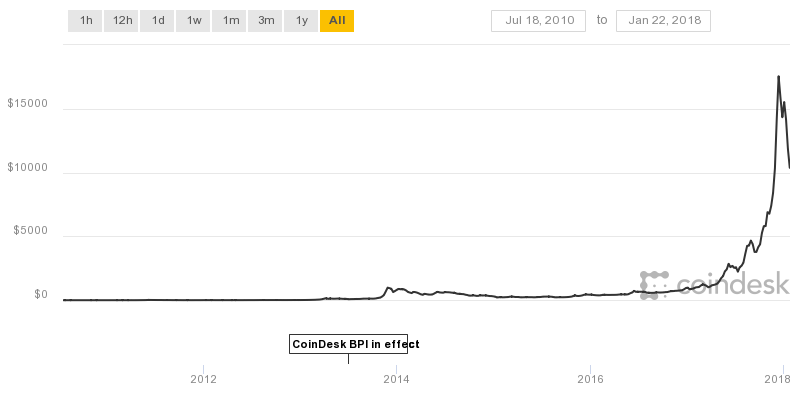

In the late 90's I bought a large amount (for me anyway) of palladium at less than $200 oz. In a short time it shot up to over a thousand dollars per ounce. And just about as fast as it went up it dropped like a rock, lost almost $800 an oz. Today it's back up to around $1000 oz again. Any investment can be risky, but some are so risky that you better have a strong stomach before investing, and know when to sell.I think the closest thing to the Bitcoin bubble is when the Hunt brothers tried to corner the silver market in 1980. Silver went from $6 an ounce to $50 an ounce in one year, then rapidly collapsed.

Gold, silver, and platinum went through a similar cycle a few years ago.

I am wondering what’s fueling the crypto currency spiraling down?

Enter your email address to join: